Finding a financial partner that truly understands your needs, whether for your home life or your business ventures, can feel like a real quest, you know? It's almost as if you're looking for a place that offers more than just transactions, a spot where genuine care for your financial well-being is apparent. That's precisely where State Bank of the Lakes steps in, providing a warm, community-focused approach to banking that many people appreciate. They've been around for a good while, actually, serving folks in Illinois and Wisconsin with a rather personal touch.

This institution, State Bank of the Lakes, is quite well-known for offering a wide array of financial products and helpful services. They've got solutions for individuals and families, and too for businesses of various sizes, which is something that really helps. From managing your daily funds to getting assistance with bigger financial plans, they aim to be a dependable resource. They also make sure you can get to your money and handle your accounts in ways that are easy and fit into your busy schedule, which is very helpful.

So, if you're curious about a banking experience that feels a bit more connected, or perhaps you're simply looking for a new place to manage your money, learning about State Bank of the Lakes could be a really good idea. We're going to look closely at what makes them stand out, from their helpful digital tools to their presence right there in your local area. You know, it's about finding out how they can genuinely support your financial journey, whatever that might look like for you.

Table of Contents

- About State Bank of the Lakes: A Community Focus

- Personal Banking Solutions for Everyday Life

- Supporting Local Businesses with Tailored Services

- Digital Convenience: Banking at Your Fingertips

- Finding Your State Bank of the Lakes Branch

- Connecting with State Bank of the Lakes Customer Service

- The Wintrust Community Connection

- Financial Strength and Security You Can Trust

- Frequently Asked Questions About State Bank of the Lakes

- Your Next Steps with State Bank of the Lakes

About State Bank of the Lakes: A Community Focus

State Bank of the Lakes, you know, has a history that goes back a good ways, having been established on January 1, 1980. That's quite a long time, actually, serving communities. Its main office is in Antioch, Illinois, and it's built a reputation over the years for being a reliable place for people to handle their money. They've got a commitment to the areas they serve, which is something many folks truly value in a bank.

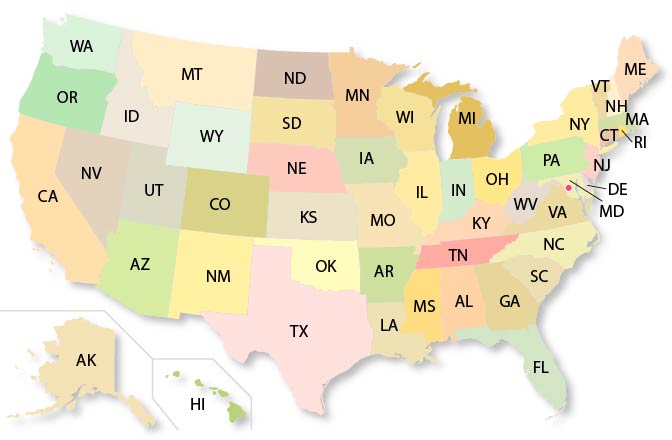

This financial institution, State Bank of the Lakes, operates with nine branch locations spread across two states. That's a decent network, you might say, making their services accessible to a good number of people. Six of these branches are located within various cities and towns in Illinois, providing local support to those communities. Additionally, they have three more offices in a different state, further extending their reach and ability to help more customers.

Their presence is particularly strong in Lake County, Illinois, where they've been serving residents for many years. For instance, the Antioch branch, located at 440 Lake Street, has been a fixture in that community for over 99 years, which is just incredible. The Grayslake branch, found at 50 Commerce Drive, has also been a key part of Lake County's financial landscape for more than 30 years. And the Lindenhurst branch, established in 1987, has been consistently meeting the financial needs of its customers in that area. This kind of long-standing commitment really shows their dedication, you know.

As a matter of fact, State Bank of the Lakes sees itself as an authentic community bank. This means they put a lot of importance on their connection with places like Kenosha, showing a real appreciation for the local area. They genuinely aim to put their customers first, which is a pretty simple idea, but it makes a big difference in how people feel about their bank. They really want to be there for all your financial needs, which is quite comforting.

Personal Banking Solutions for Everyday Life

When it comes to managing your own money, State Bank of the Lakes offers a variety of solutions designed to make things easier. They have personal banking options that cover everything from checking accounts for your daily spending to savings accounts that help you put money aside for future goals. You know, it's about providing the right tools for whatever your financial picture looks like. They understand that everyone's needs are a bit different, and they try to cater to that.

Beyond just accounts, they also provide financial news and educational resources. This is actually quite helpful for people who want to learn more about managing their money better or understanding different financial concepts. It's like having a little bit of guidance right there, which can be really empowering. They want you to feel confident about your financial choices, which is a good thing.

For those bigger life moments, State Bank of the Lakes can also help. While the text mentions mortgage loan information, it suggests you can request it online, indicating they are involved in helping people with home ownership. It’s pretty clear they want to be a comprehensive resource for their customers, offering support through various stages of their financial lives. You know, it’s not just about depositing money; it’s about building a financial future, in a way.

They also offer convenient ways to access your money, such as ATM/debit card services. This means you can get cash or make purchases easily, which is pretty standard, but still very important for daily life. So, you know, they've got the basics covered, and then some, to make personal banking as smooth as possible for you.

Supporting Local Businesses with Tailored Services

State Bank of the Lakes truly understands that businesses, especially the smaller ones, have very specific financial needs. They offer a range of business banking solutions designed to help companies grow and manage their money effectively. This includes things like managing your business accounts online or through your mobile device, which is incredibly convenient for busy entrepreneurs, as a matter of fact.

They provide various options for businesses, including deposit solutions to keep your earnings safe and accessible. Furthermore, they offer credit card options that can help with business expenses and cash flow management, which is often a pretty important aspect for any company. And for businesses that need equipment or vehicles, they also have leasing options available, which can be a flexible way to acquire necessary assets without a large upfront cost.

The bank also offers treasury management support, which is a more advanced service for businesses that need help optimizing their cash flow and financial operations. This kind of support can be really valuable for companies looking to streamline their financial processes and make sure their money is working as hard as it can for them. It shows a deeper level of commitment to business clients, you know.

They aim to be a genuine partner for local businesses, providing the tools and advice needed to succeed. It's about more than just providing a place for deposits; it's about offering a suite of services that can genuinely contribute to a company's stability and expansion. They truly want to see local enterprises thrive, which is good for the whole community, actually.

Digital Convenience: Banking at Your Fingertips

In today's fast-paced world, being able to manage your money from anywhere is pretty essential, you know? State Bank of the Lakes gets this, and that's why they've put a lot of effort into their digital banking services. You can access online banking from your computer, which is really handy for checking balances, transferring funds, or paying bills without having to visit a branch. It makes life a bit simpler, that's for sure.

They also offer a mobile app that you can download, which puts banking right in your pocket. This means you can manage your accounts on the go, whether you're at home, at work, or out and about. It's very convenient for keeping an eye on your finances and doing quick transactions whenever you need to. You know, it’s about making banking fit into your life, not the other way around.

Through these digital platforms, you can do quite a lot. You can check your account balances instantly, which is something many people do several times a week. Transferring funds between your accounts or to others is also a breeze. And if you have a mortgage loan with them, you can even request information about it online, which saves you a phone call or a trip. It's pretty comprehensive, actually, what you can do from your device.

These digital tools are designed to give you more control and flexibility over your finances. They complement the in-person service you get at their branches, offering a complete banking experience that suits various preferences. So, whether you prefer clicking or tapping, State Bank of the Lakes has got you covered, you might say, making banking accessible and efficient.

Finding Your State Bank of the Lakes Branch

Even with all the digital convenience, sometimes you just need to talk to someone face-to-face, or you might need to use a service that requires a physical location. State Bank of the Lakes understands this, and that's why they maintain a network of branches to serve their customers personally. They have nine locations in total, spread across Illinois and Wisconsin, which is quite a reach, you know.

You can easily find State Bank of the Lakes branch locations, including their hours of operation, the services available at each spot, and even driving directions to help you get there. This information is readily available, so you can plan your visit accordingly. They really want to make it easy for you to stop by and see them soon, which is pretty welcoming.

For instance, their headquarters is located at 440 Lake Street in Antioch, Illinois. This is a central point for their operations and has been serving the community for nearly a century, which is just incredible to think about. Another key location is the Grayslake branch, situated at 50 Commerce Drive in Grayslake, Illinois. This branch has been a part of Lake County for over 30 years, building strong connections with local residents and businesses.

The Lindenhurst branch, established in 1987, is another one of their nine locations, providing financial services to that part of Lake County, Illinois. Each branch is there to offer personal attention, something you can really only expect from a local community bank. They even provide routing numbers for each location, which is useful for setting up direct deposits or wire transfers. So, you know, they've got all the details covered for your convenience.

Connecting with State Bank of the Lakes Customer Service

Getting help when you need it is a really important part of any banking relationship, you know? State Bank of the Lakes makes it pretty straightforward to reach their customer service team. They offer several ways to get in touch, so you can choose the method that works best for you, which is very thoughtful.

You can find out how to reach their general customer service, which is great for most inquiries. For specific needs, they also have dedicated lines for telebank services, which is handy for automated account information. If you have questions about your ATM or debit card, there are specific services for that too, which can be really helpful if you've lost a card or have a transaction question.

Businesses, particularly, can benefit from their treasury management support, which is a specialized service designed to help with more complex financial operations. This shows they are equipped to handle a wide range of customer needs, from simple account questions to more intricate business support. They really aim to provide comprehensive assistance, you know.

Beyond just calling, you can also manage many things online. For example, you can file a complaint if you have an issue, check your balance whenever you want, transfer funds between accounts, and even request information about your mortgage loan. This online access means you can often resolve your questions or complete tasks without needing to speak to someone directly, which is a huge time-saver for many people, actually.

The Wintrust Community Connection

State Bank of the Lakes is part of something bigger, you know? It's a Wintrust community bank, which means it belongs to a larger family of financial institutions. This connection can bring a lot of benefits to customers, as it combines the personal touch of a local bank with the resources and stability of a larger banking group. It's like having the best of both worlds, in a way.

Being a Wintrust community bank means they share a commitment to local service while also having access to a broader network of financial expertise and technology. This can translate into more advanced digital tools, a wider range of product offerings, and enhanced security measures, all while maintaining that local, approachable feel that customers appreciate. It's a pretty strong combination, you might say.

This affiliation helps State Bank of the Lakes continue its mission of putting customers first and supporting the communities it serves. It allows them to provide competitive rates and services that might not be available at smaller, independent banks, while still keeping that authentic community bank identity. So, you know, it's a partnership that benefits everyone involved, especially the customers.

The Wintrust connection really reinforces their ability to be there for all your financial needs, from personal accounts to complex business solutions. It's another layer of assurance that you're banking with an institution that is both deeply rooted in its local areas and backed by a robust financial organization. That's a pretty good thing to know, actually, when you're choosing a bank.

Financial Strength and Security You Can Trust

When you choose a bank, knowing that your money is safe and that the institution is financially sound is pretty important, you know? State Bank of the Lakes has assets amounting to $931,542,000, which is a rather significant figure. This level of assets suggests a strong financial foundation, giving customers confidence in the bank's stability and ability to meet its obligations. It's a key indicator of their overall health, actually.

Furthermore, deposits in State Bank of the Lakes are insured by the FDIC, which stands for the Federal Deposit Insurance Corporation. This is a crucial piece of information for any customer, as it means your money is protected up to certain limits in the unlikely event that the bank fails. This insurance provides a very important layer of security and peace of mind for depositors, which is something everyone wants from their bank.

The bank is also ranked #1,051 in the U.S., which gives you a sense of its standing among financial institutions nationwide. This ranking, combined with over 20 years of financial information available for review, provides transparency and allows potential customers to assess its long-term performance. You know, having that kind of historical data available is pretty helpful for making informed decisions.

With its headquarters in Antioch, IL, and its network of branches, State Bank of the Lakes has built a reputation for being a reliable and secure place for people to manage their finances. The fact that its customers are served from eight locations, and it has a total of nine branches, further highlights its operational presence and commitment to accessibility. All these factors combined paint a picture of a bank that is both financially sound and dedicated to its customers' security, which is very reassuring.

Frequently Asked Questions About State Bank of the Lakes

Here are some common questions people often ask about State Bank of the Lakes:

What kinds of services does State Bank of the Lakes offer?

State Bank of the Lakes offers a wide range of services for both personal and business banking. For individuals, they provide checking and savings accounts, digital banking services, and financial education. Businesses can access solutions for managing accounts online, credit card options, leasing, and treasury management support. They really aim to cover most financial needs, you know.

Where are State Bank of the Lakes branches located?

State Bank of the Lakes operates nine branches across Illinois and Wisconsin. Six of these locations are in various cities and towns within Illinois, including their headquarters in Antioch and branches in Grayslake and Lindenhurst. They also have three additional offices in another state. You can find full listings with addresses, hours, and driving directions on their website, which is very convenient.

How can I contact State Bank of the Lakes customer service?

You can reach State Bank of the Lakes customer service through various channels. They provide contact information for general customer service, telebank services, and ATM/debit card support. For businesses, there's also dedicated treasury management support. Additionally, you can manage many aspects of your account online, like checking balances, transferring funds, or requesting mortgage loan information, which is pretty handy.

Your Next Steps with State Bank of the Lakes

If you're considering a bank that combines local community values with comprehensive financial services, State Bank of the Lakes certainly presents a compelling option. They make it pretty easy to get started, you know, with a convenient online account opening process. You're just moments away from experiencing the kind of personal attention that you can truly only expect from a local community bank, which is a big plus for many people.

Whether you're looking for everyday personal banking, robust business solutions, or the convenience of digital tools, they aim to provide a supportive and secure environment for your money. They have a long history of serving their communities, and that commitment is something that truly stands out. It's about building relationships, actually, not just processing transactions.

To learn more about their offerings and how they can assist you, you might want to visit their website or stop by one of their branches. You can also find more information about their services and community involvement on our site, like your homepage, which has more details. Or, for specific financial insights, you could also check out this page: financial education resources. They are genuinely there for all your financial needs, and they invite you to experience the difference a community-focused bank can make. For more details on their operations and history, you could look up their official financial reports, as a matter of fact, like those found on the FDIC website.

Detail Author:

- Name : Mrs. Elisa Tromp

- Username : weimann.jessie

- Email : gschaefer@schneider.info

- Birthdate : 1982-01-09

- Address : 45434 Jenkins Locks Suite 037 Marieton, MO 49535

- Phone : +1 (530) 916-7118

- Company : Smith-Schaefer

- Job : Steel Worker

- Bio : Maxime doloremque voluptatem nihil mollitia. Praesentium adipisci quae nobis quasi. Maxime possimus saepe sapiente id et officia vero.

Socials

twitter:

- url : https://twitter.com/halvorsonc

- username : halvorsonc

- bio : Iste similique sint vitae aperiam iusto. Adipisci reiciendis necessitatibus ratione esse laboriosam quae. Est doloremque laborum quo ut repellat est.

- followers : 4949

- following : 1975

facebook:

- url : https://facebook.com/carol.halvorson

- username : carol.halvorson

- bio : Illum nesciunt quod consectetur tenetur dolore praesentium molestias.

- followers : 3747

- following : 2405